Prioritize Saving, Then Spending

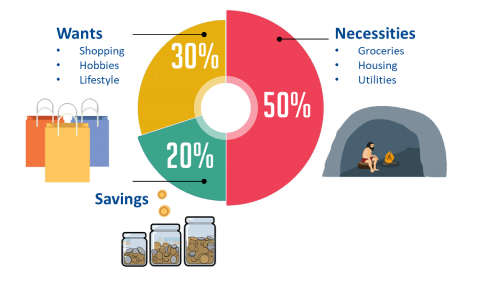

The “50/30/20 budget rule” is a simple guideline for managing your finances and budgeting your income effectively. It suggests dividing your monthly income into three categories:

This budgeting approach provides a structured way to balance your financial responsibilities while allowing you to enjoy some of your earnings. It promotes financial stability, savings, and prudent spending habits. However, keep in mind that these percentages can be adjusted to fit your specific financial goals and circumstances. The key is to ensure that you allocate a portion of your income towards both savings and paying off debts to secure your financial future.

Remember Warren Buffett’s advice:

“Spend what is left after saving, not what is left after spending.”

Let's chat with us