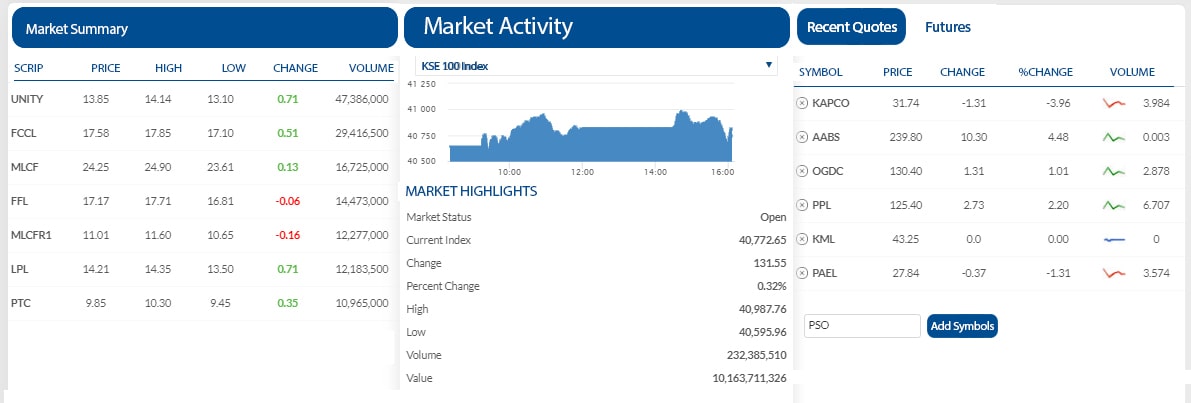

With each unit of JSGBETF, you can track:

Performance of 8 commercial banks using PSX’s BKTI index as a benchmark. The fund is a tradeable security and investors can easily buy and sell units on the stock exchange, just like any other stock.

What is JSGBETF:

A sector ETF that tracks a basket of stocks within a sector.

JS Global Banking Sector Exchange Traded Fund (JSGBETF) is a sector-specific ETF that will track a total-return based index – JS Global Banking Sector Index (JSGBKTI).

JSGBKTI will be replicating BKTi, keeping weights of all stocks equal on each rebalancing.

JSGBETF currently consists of 8 banking stocks, that represents 70%* of the listed banking sector (80%* on freefloat market cap).

*Approximate

Benefits of JSGBETF

Constituents of the fund are transparent and their financial performance is public information

ETFs have a lower expense ratio relative to equity mutual funds.

The indicative NAV (iNAV) is updated on real-time basis.

JSGBETF constituents

Advantages of a sector-specific ETF

Sector ETFs can help in investing in one industry without buying individual stocks from that sector.

Entry and exit and/or exposure change in sector is smoother, compared to trading in individual stocks.

Exposure to a significant weight of the sector can be taken with limited funds.

Can be traded with liquidity during intraday trading.

Why banking sector of Pakistan?

Banking sector is currently trading at record-low multiples, with robust profits.

The sector is resilient to ongoing macro reforms, providing profit growth in the ongoing cycle.

Higher dividend yield of multiple banks provides value in a total return index.

Rising return generation with attractive multiples