Active and Passive Income

Never depend on single income, make investment to create a second source

Warren Buffet

If you don’t find a way to make money while you sleep, you will work until you die.

Active Income

when you don’t work, you can’t earn.

Passive Income

Your Passive income should be your second source of income which is working without your direct or with your minimum involvement.

Its enabling of your saving and investments to work for you, even when you are sleeping.

Active Income:

Active income refers to money earned as a result of performing a specific task or providing a service. It requires active participation, effort, and time.

Examples:

Salary: Income earned through employment, where you exchange your time and skills for a paycheck.

Wages: Payments for hourly or task-based work.

Self-Employment Income: Money earned through running a business or freelancing.

Commission: Earnings based on sales or transactions.

Passive Income:

Passive income is money earned with little to no direct effort or active involvement. It often involves initial time, money, or resource investments that generate returns over time.

Examples:

Rental Income:

Earnings from properties or real estate investments.

Dividend Income:

Money received from owning shares in companies that distribute dividends.

Royalties:

Payments for the use of intellectual property like books, music, or patents.

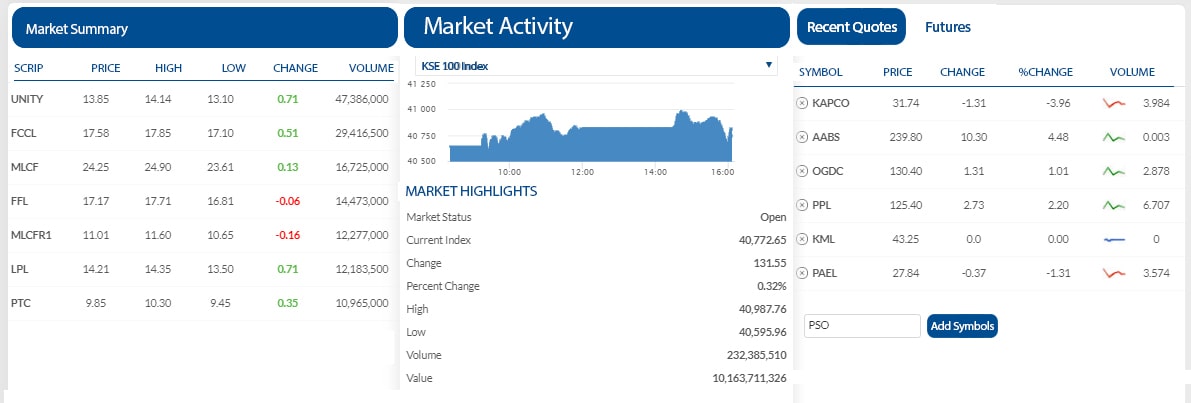

Investment Income:

Returns from investments in stocks, bonds, or mutual funds.

Let's chat with us