“Let’s suppose you want to develop a passive income from your monthly savings of Rs. 500.

Property for Rental Income:

When considering rental income, can you acquire a significant asset? No, because you need an upfront payment for that.

Starting a Business:

For a business, can you establish a production factory, set up sales, marketing, and administration costs?

This also involves significant costs, and how can you mitigate the risks of starting a new business?

You should only invest in a business if it:

Offers legitimate products and services

Demonstrates good demand, cash flows, and margins.

Stock Investment:

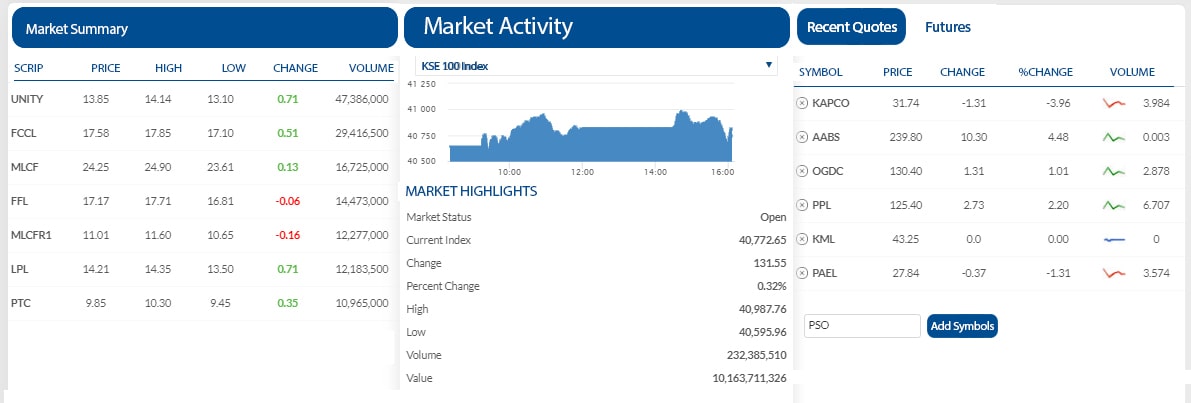

When it comes to stock investment, you can choose from hundreds of companies.

Select a well-performing company with a business model that suits you.

Most companies on the stock exchange offer shares priced at or below Rs. 500. You can start investing with the purchase of a single share or a minimum share lot. This enables you to become a partner in the company, sharing in its profits and losses proportionate to your investment, and start building your assets with your small savings amount

To mitigate risk in the stock exchange, diversify your portfolio by investing in different types of shares across various sectors.

However, it’s important to note that investing in equities also carries risks, including market volatility. It’s essential to have a well-thought-out investment strategy, diversify your portfolio, and consider your risk tolerance and long-term financial goals.”

Let's chat with us