STOCK RETURNS

The profit or loss derived from an investment is the key for an investment decision. By investing in shares in a public company listed on a Stock Exchange you get the right to share in the future income and value of that company. Your return can come in two ways:

The profit or loss derived from an investment is the key for an investment decision. By investing in shares in a public company listed on a Stock Exchange you get the right to share in the future income and value of that company. Your return can come in two ways:

1. Dividend

2. Capital Gain /Loss

1. Dividend

Dividends are the returns corporation pays to its shareholders at the end of each financial year closer. Company earnings are distributed among shareholders in the form of dividend.

The salient features of dividend are:

- Dividends are usually settled on a cash basis, as a payment from the company to their shareholder. A dividend is allocated as a fixed amount per share. Therefore, a shareholder receives a dividend in proportion to their shareholding in the company

- Sometimes companies issue shares in the form of dividend mostly called scrip/stock dividend

- Public companies usually pay dividends on a fixed schedule, but may declare a dividend at any time, sometimes called a special dividend to distinguish it from regular ones

- When a company declares the dividend in any form (called DECLARATION DATE) it sets a date when shareholder must be on company’s books to receive dividend. This date is called RECORD DATE. Based on this date company also determines who is sent proxy statements, financial reports and other information

- Based on the Record date of the dividend, Stock Exchange sets the EX-DIVIDEND DATE which is two days before the record date. This is the cut-off date of book closure for the existing shareholders confirmation. If you purchase shares on or after Ex-Dividend date then you will not be entitled for receiving dividend.

- The payment date is the day when dividend cheques / shares are actually transferred to the shareholders of the company or credited to the brokerage accounts

2. Capital Gain/Loss

Capital Gains / Loss are the appreciation/(depreciation) of Stock value from the amount you paid to acquire shares. Capital gains are made because you’re able at some time to sell your shares for more than you paid. Gains may reflect the fact that the company has grown or improved its performance or that the investment community sees that it has improved future prospects.

The salient features of Capital Gain /Loss are:

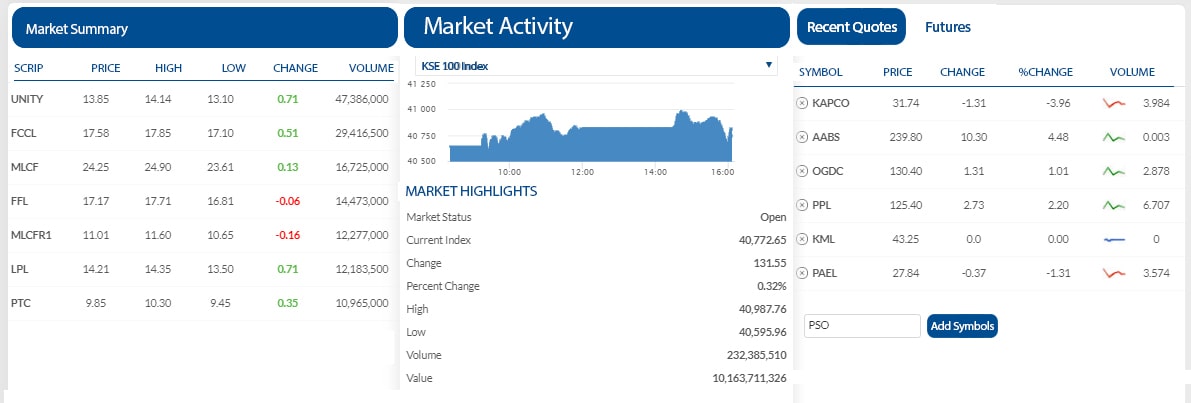

- Price appreciation / (depreciation) happens due to shares trading in the secondary market (Stock Exchange)

- The price of shares in any individual public listed company can vary from day to day. On any day some shares may go up in value and some down, depending on how investors view the prospects of each company

- And all of the listed company shares in a particular country or industry may increase or decrease in price because of rises and falls in economic confidence or changes in the particular industry

- Overall the long-term trend is for the value of listed companies to increase at a rate higher than inflation. Therefore by investing in a wide range of companies operating in a range of industries and countries, an investor has a good chance of making long-term gains

- Remember that in assessing the return from shares you need to take into account dividends received as well as capital gains. You should also expect that the dividends from the shares that you own will increase over time

This may not be a wise decision to invest short term in a very volatile stock. Shares should be used as a long-term investment.