Brokerage Procedures for Investors

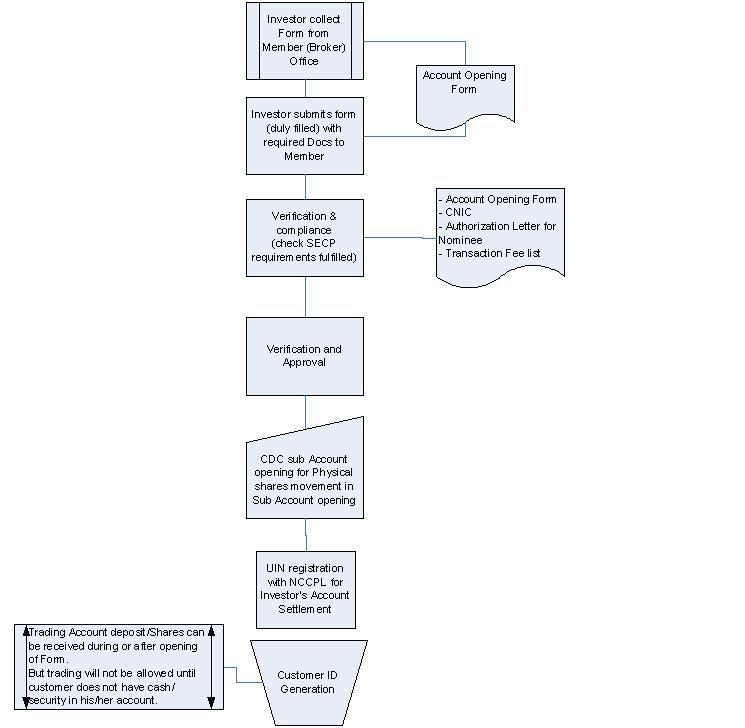

1. Account Opening

An investor can not open an account directly with Stock Exchange. To invest in stock market you need to open a trading account with a registered member of Stock Exchange. SECP, as a governing body of Stock Exchange members, has developed standard “Code of conduct” for brokers for securing investor’s interests. All these rules are monitored and audited by SECP time to time. Brokers maintains all legal requirements based on their standards given be SECP.

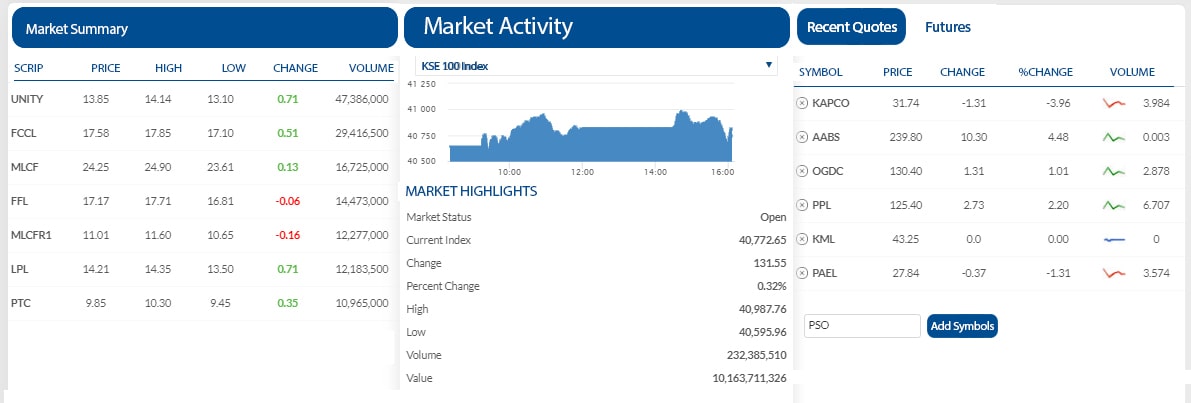

2. Traditional Trading Process

3. Delivery & Settlement

All regular market transactions follow the T+2 settlement system. E.g. shares bought on Monday will be delivered and paid on Wednesday. Settlement is done based on the Position available in CDC account. In case of non compliance on the settlement date, brokers give margin calls to the investor to clear the position. PSX allows provisional trading in the company which is going for IPO. The provisional trading starts from the date of publication of offering documents. The Stock Exchange specifies the period of provisional trading and the settlement dates of the IPO. On formal listing, a company’s shares transfer onto the ready market with T+2 settlements. When investors trade in shares 5 days before the company’s share transfer book closure, transactions are settled on the next day of trade execution. This is called SPOT/T+1 Transactions. Future Contracts are settled once in a month and their settlement dates are based on the suspension of their trade.

4. Physical Shares Handling

Central Depository Company (CDC) is a part of the Stock Exchange Trading System. Every broker is required to maintain their customer’s physical shares movement through CDC where electronically securities transfer from one hand to another. This is the reason CDC sub account is mandatory for all investors managing their securities movement. An Investor can open his/her sub-account directly or through a broker. If case of having physical securities, registration with CDC is required to have them placed in your account. Investors can also get issued their current holding of shares in physical form from CDC.

Long Term: More than 5 years

The longer you invest, the higher your return expectations. So you need to make sure that you’ll be able to get it when you need it.For example your goal is to have money at your retirement age so you can invest for a long period like 10-20 years.