Shares Trading in Pakistan

Capital Markets in Pakistan consists of three Stock Exchanges: Karachi, Lahore and Islamabad. Thye all are merged and now call as ‘Pakistan Stock Exchange’. The principal trading activities are in ordinary shares but other securities like mutual certificates, government and corporate bonds, and TFCs are also offered in the market. Securities traded in a Pakistan Stock Exchange Limited is ordinary shares, right shares and TFCs. The major developments in Capital market included automation of trading system (KATS), CDC’s Electronic book entry system of shares handling (CDS), and independent National Clearing & Settlement System (NCSS).

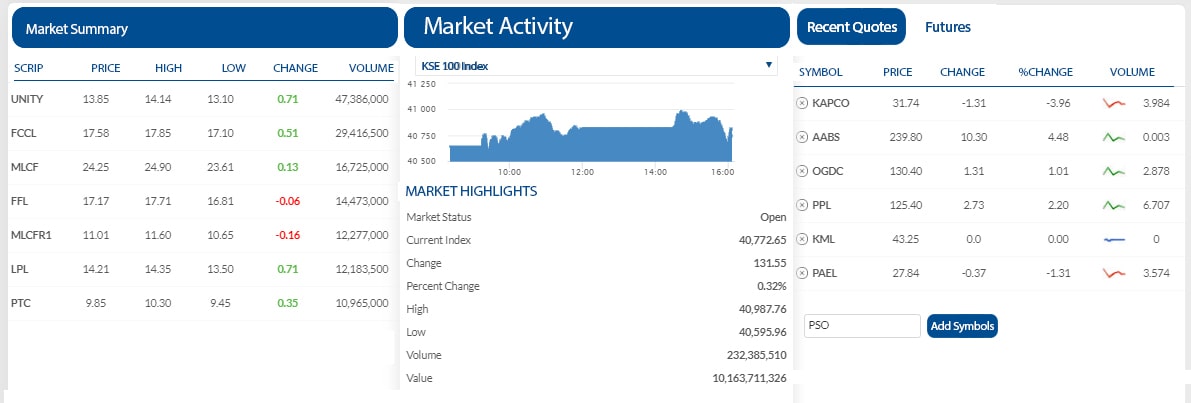

a. Ready Market

The ready market means the market where trades are settled on rolling settlement basis, based on actual delivery. In Ready Market, all listed companies shares are traded during regular market time. Regular market works on T+2 settlement system.

b. Future Market

Future market means where future contracts are traded on daily basis and settled on monthly basis. A Futures contract involves purchase and sale of securities at some future date (normally within one calendar month), at a price fixed today. These contracts are traded on an organized and regulated futures exchange enabling buyers and sellers to transact business. A futures contract gives the holder the obligation to buy or sell and both parties of a “futures contract” must fulfill the contract on the settlement date.

The future market trading specifications include:

- Contracts are period specific by the exchange. Contracts for different months shall trade simultaneously based on any corporate announcement expected in scrip

- New contract period starts at least two days before the close of the old contract

- The Stock Exchange determines the number of securities traded in future market and/or addition or deletions to the existing list

- Trading in future market takes place through the trading system available for trading in all markets

- Contracts opens on Monday-preceding in the last Friday of the month

- Contracts close on last Friday of the calendar month

- Contracts Settlement executes on Tuesday following after the close of contract

- The investors entering into future market shall pay deposit against their exposures in accordance with Risk Management system of Broker

c. Margin Financing System

The Margin Financing System (MFS) Market is available for the entire trading period and runs parallel to the Ready Market. In addition, the MFS Market is available for one and half hour after the close of trading

MFS means a financing facility made available by the Margin Financier to its Margin Financee to partially finance the purchase of MF Eligible Securities in the ready market.