PAKISTAN STOCK EXCHANGE RISK MANAGEMENT SYSTEM

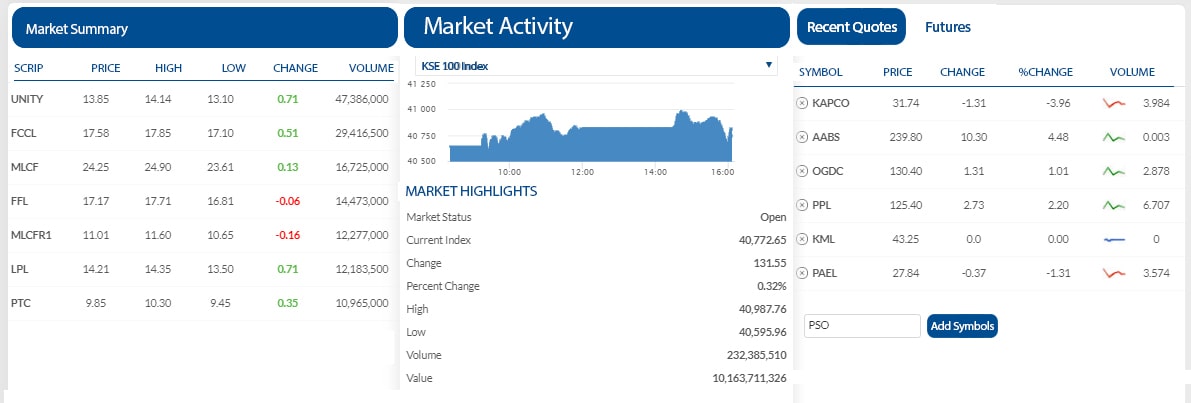

Risk management system for PSX and members are different. A PSX risk management system covers all trading markets. The risk management systems features include:

1. Exchange trading systems monitor security wise, client wise and market wise exposure of each member in all markets.

2. PSX allows members an exposure limit of 25 times their net balance which is calculated periodically.

2. Traditional Trading Process

3. All positions are taken on net basis for each market traded in the PSX and based on that Margin requirements are monitored.

4. The system will take into account actual traded values for the purpose of calculating Exposure.

5. All trades due for settlement on that day will be excluded for calculation of Exposures, once settled.

6. In case the day end position crosses the exposure, Members are required to deposit a margin to maintain the net capital balance exposure clause.

7. Different markets margin deposits are:

- Ready Market – 100% cash requirement

- Future Market – 30% margin in the form of cash/custody with a minimum of 15% cash*

- MFS & MTS -30% margin in the form of cash/custody with a minimum of 15% cash*