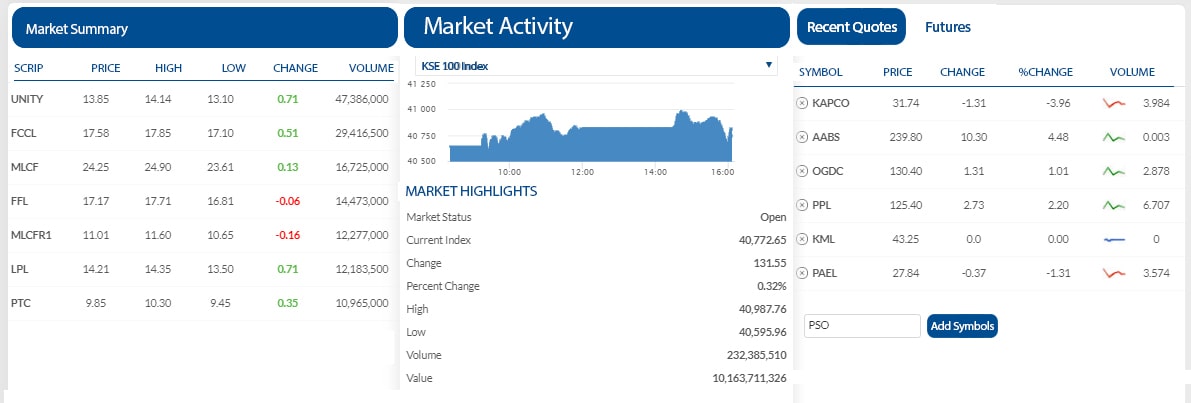

COMMON TERMS OF TRADING SCREEN

Following are the most common terms of trading screen

Market

The type of trade in which the Security falls

Symbol

Unique short name assigned to any particular script by KSE.

Change

Difference between the last traded and close of the previous day’s price

Buy Vol

No. of Securities investor intends to buy

Buy

The rate at which investor intends to execute his/her buy order

Sell Vol

No. of Securities investor intends to sell

Sell

The rate at which investor intends to execute his/her Sell order

Last Vol

No of Securities executed/traded in previous/last trade.

Last Price

The price at which last trade took place

Total Vol

Total No. of Securities traded during a particular time/day

Avg

Total value of Security traded, divided by No. of Securities traded

High

The highest rate at which the Security traded

Low

The lowest rate at which the Security traded

Prev. Close

Previous day’s closing price

Trade Time

The time at which the trade took place

Limit Order

A limit order is when the user enters the order into the system with a specific price

Market Order

A market order is when the user enters the order into the system without a specific price. The system will execute the order irrespective of price. The system will search for the quantity of order to be completed at any available price. In a rapidly moving market, a market order may be executed at a price higher or lower than the quote displayed on the website at the time of order entry.

Market Lot

Market Lot is the normal unit of trading for a security, which is 500 shares of stock having price less than Rs.50/- and 100 shares of stock having price above Rs.50/-.

Odd Lots

For stocks, any transaction less than the market lot is usually considered to be an odd lot. These odd lots cannot be traded on the regular market and hence the Karachi Stock Exchange has initiated a separate ODD Lots Market.

Margin Call

A margin call most often occurs when the amount of actual capital the investor has, drops below a set percent of the total investment. A margin call may also be triggered if the broker changes their minimum margin requirement which is the absolute minimum percentage of the total investment that one must have in direct equity.

Stop Loss Order

A stop-loss order is a request to sell a security once the market price reaches or falls below an investor -specified price. Once the target price has been reached or surpassed, the order becomes a “market” order. This is especially true in a fast-moving market where stock prices can change rapidly. A stop-loss order is typically used to sell a security, to lock in profits or limit losses if a security price falls. Setting a stop-loss order for 5% below the price at which you bought the stock will limit your loss to 5%. Stop-loss orders are only available when selling a security to close a position.

Short Sell

Short selling refers to the practice of selling securities the seller owns in the hope of repurchasing them later at a lower price. This is done in an attempt to profit from an expected decline in price of a security. Such as a stock or a bond, is contrast to the ordinary investment practice, where an investor “goes long,” purchasing a security in the hope the price will rise.